If you’ve been exploring crypto you may have come across the term bonding curve—a concept that plays a key role in the way assets are priced and traded. One project that leverages this mechanism in an innovative way is Pump Fun, a platform that automates token creation and trading. But what exactly is a Pump Fun bonding curve, and why should you care?

What is a Bonding Curve?

At its core, a bonding curve is a mathematical formula that determines the price of a token based on its supply. Unlike traditional markets where price is determined by buyers and sellers negotiating, a bonding curve automates pricing based on preset rules.

As more tokens are bought, the price increases along the curve. Conversely, when tokens are sold back to the smart contract, the price decreases in a predictable way.

How Pump Fun Uses the Bonding Curve

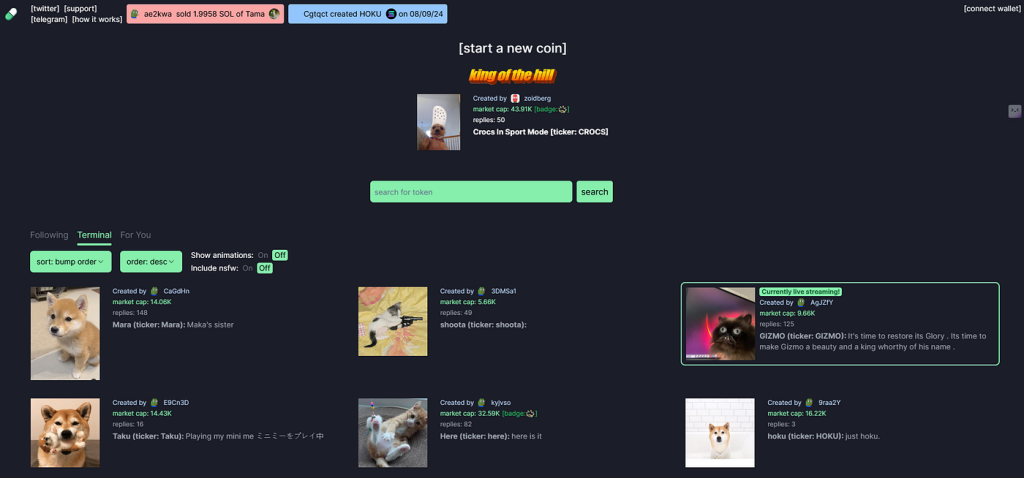

Pump Fun allows users to create and trade tokens instantly using a bonding curve mechanism. Here’s how it works:

1. Token Creation – Users can launch their own token in seconds. The smart contract automatically manages its liquidity.

2. Price Discovery – The bonding curve ensures that early buyers get lower prices, while later buyers pay progressively more.

3. Automated Liquidity – No need for external liquidity pools; the smart contract handles token buy/sell actions automatically.

4. Instant Trading – Users can buy or sell tokens at any time without needing a counterparty, since the contract itself acts as the buyer/seller.

Why does the bonding curve matter?

The Pump Fun bonding curve creates a fair, transparent, and automated way to launch and trade tokens. This is beneficial for:

• Creators who want to launch tokens easily without dealing with complex liquidity setups.

• Traders looking for opportunities to enter early and benefit from price appreciation.

• DeFi Enthusiasts who appreciate decentralized mechanisms for price discovery.

Potential Risks and Considerations

While bonding curves offer exciting possibilities, they also come with risks:

• Volatility – Prices can rise and fall quickly as buying/selling occurs.

• Liquidity Constraints – If demand drops, token prices can fall significantly.

• Smart Contract Risk – Like any DeFi project, security vulnerabilities could be exploited.

Pump Fun’s bonding curve is an innovative approach to automated token pricing and trading. Whether you’re launching a token or speculating on new ones, understanding how the bonding curve works can help you make more informed decisions.

Got questions about bonding curves or Pump Fun? Email our developer at dev@mysolbot.com

Learn more about our Pump Fun sniper trading bot and never get rug pulled again!